With over 40 branches, UOB is a famous multinational bank that offers various credit cards for its users. If you’re currently on the hunt for a credit card, make sure you keep UOB in mind!

Each UOB credit card offers different privileges, benefits and rewards. Be it for dining, shopping, entertainment; you name it! You can even claim rewards through its UOB UNIRinggit Rewards Programme – all you have to do is collect rewards points. UOB has credit cards which are sure to meet the needs of everyone.

For today’s article, we have listed out all of UOB credit cards. We have included an overview of the benefits, eligibility and how you can apply for the cards. Without further ado, let’s get to it.

1. UOB Preferred Platinum Mastercard®

Benefits & Features

- 0% for Overseas Easi-Payment Plan

- Obtain 3X of UNIRinggit reward points for overseas expenditures

- Obtain 2X of UNIRinggit reward points for dining expenditures

- Receive 1X of UNIRinggit reward points for other expenditures

- Get 10X UNIRinggit reward points for any hotel stay (with Booking.com)

2. UOB Visa Infinite Card

Benefits & Features

- Receive RM50 cash voucher in 32,000 UNIRinggit when you activate your card and make a minimum spending of RM3,000 (must be within 60 days since card’s approval date)

- Obtain 5X of UNIRinggit reward points for overseas expenditures

- Obtain 1X of UNIRinggit reward points for other expenditures

- Enjoy free limousine services in Singapore

- Enjoy 25% off the fast track immigration speed pass (at over 400 international airports)

- Receive 20% of the TBR Luxury Airport Transfer Service when overseas

- Get discount up to 20% at airport dining outlets

- Obtain SMART$ rebates at any merchant outlet of SMART$ through UOBM terminals

- With the UNIRinggit reward points which you collected, you can redeem 2X of Air Miles on your birthday month (T&C apply)

- Get travel insurance coverage up to RM500,000

- Enjoy 30% off green fees in more than 15 of Asia Pacific’s selected golf clubs

- Free year-round green fares for Malaysia’s selected golf clubs

- No interest for Easi-Payment Plan for overseas expenditures of RM3,000 and more

- No interest for EPP for medical fees, education or luxury purchases up to RM10,000

- Visa Infinite Concierge Services

- You can redeem rewards with the UNIRinggit collected (shopping vouchers, dining vouchers, annual fee waiver, air miles and many more)

3. UOB Lady’s Mastercard® (Classic/Platinum/Solitaire)

Benefits & Features

- Get 10% cashback every Saturday and Sunday for fashion spends (Fashion Ten)

- Obtain 1X of UNIRinggit reward points for all expenditures

- LuxePay Plan: With a luxury purchase that is worth RM2,000 or more, you can convert it into a 6 or 12-month 0% p.a. instalment payment plan

- 0% Overseas Easi-Payment Plan: When your expenditures reach at least RM3,000 in a single or added receipt(s) in any foreign currency, you can convert it to a three-monthly repayment with 0% p.a. interest

- Get travel insurance coverage up to RM500,000 (exclusively for UOB Lady’s Solitaire Mastercard® principal or supplementary cardholders, child and spouse)

- Exclusive discounts and deals for fashion & shopping, dining & entertainment, beauty & wellness and travel & lifestyle

- Interest-free for 20 days

- Credit card exclusively for ladies

4. UOB ONE Card/UOB ONE Platinum Card

Benefits & Features

- Enjoy unlimited cashback for everyday expenditures like petrol, groceries, phone bills and movies

- Obtain up to 8% cash rebates and save up to RM638.40 in a year

- Cash rebates have no minimum purchase required

- Get 10% cashback for Grab rides

- Enjoy exclusive leisure, travel, healthy & beauty privileges and discounts

- Get up to 15% off for dining at over 100 selected restaurants (nationwide)

- 0% Overseas Easi-Payment Plan

- Interest-free for 20 days

5. UOB PRVI Miles

Benefits & Features

- Obtain 10X of UNIRinggit for online reservations with key travel partners (for every RM1 spent)

- Obtain 5X of UNIRinggit for online purchases on hotels, airlines, overseas and travel agencies (for every RM1 spent)

- Receive up to 10X of UNIRinggit for hotel reservations via Booking.com

- Receive up to 12X UNIRinggit for reservations on flight or hotel via Expedia

- Redeem miles from over 55 partner airlines

- Redeem up to 7 Air Miles with Asia Miles, AirAsia BIG Points, KrisFlyer and Enrich Miles (for every RM10 spent)

- With the promo code “grabprvi”, you get to enjoy 50% of your Grab rides (to and from airport)

- A chance to offset your annual fee with collected UNIRinggit

- Special discounts and offers for shopping, dining and travelling from UOB Privileges Passport

- You can redeem any rewards that you want from UOB UNIRinggit Rewards Catalogue

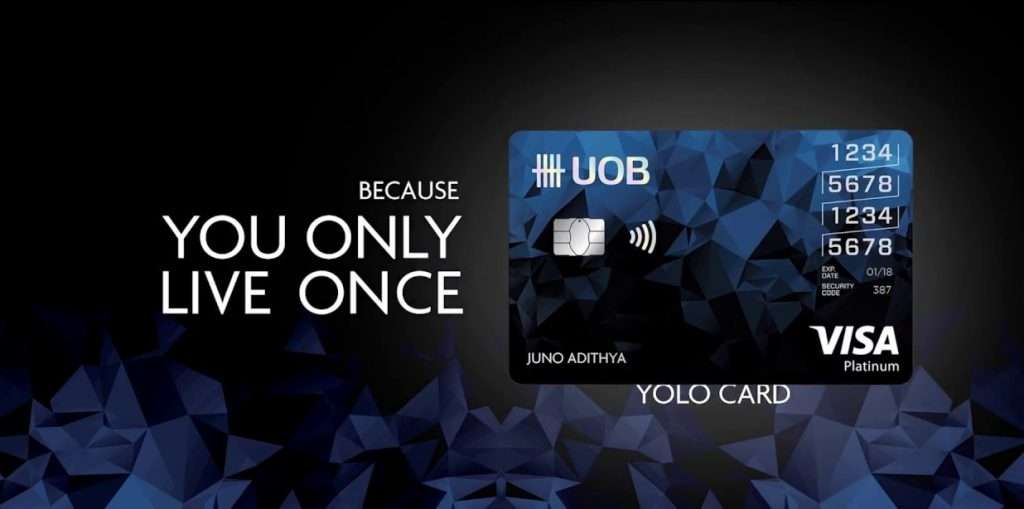

6. UOB YOLO Card

Benefits & Features

- Obtain up to 8% cashback for dining and online expenditures (up to RM600 each year)

- 0% Overseas Easi-payment Plan: With a minimum spend of RM3,000 in a single or added receipt(s) made on overseas, you can convert to a 3 monthly repayments at 0% interest (T&C apply)

- Make payments with the built-in visa contactless payment feature

- Get exclusive UOB privileges and discounts for shopping, health & beauty, dining and travel & lifestyle

- Interest-free for 20 days

Annual Fee for UOB Credit Cards

| UOB CREDIT CARD | INCOME REQUIREMENT (ANNUAL) | ANNUAL FEE (PRINCIPAL CARD) | ANNUAL FEE (SUPPLEMENTARY CARD) |

|---|---|---|---|

| Preferred Platinum Mastercard® | RM40,000 | RM198 | RM30 |

| Visa Infinite Card | RM120,000 | RM600 | RM300 |

| Lady’s Mastercard | |||

| Classic | RM24,000 | RM68 | RM40 |

| Platinum | RM48,000 | RM128 | RM30 |

| Solitaire | RM100,000 | RM300 | RM30 |

| ONE Card | RM24,000 | RM68 | RM30 |

| ONE Platinum Card | RM48,000 | RM168 | RM30 |

| PRVI Miles | RM60,000 | RM198 | RM30 |

| YOLO Card | RM36,000 | RM90 (RM7.50 per month) | RM30 |

NOTE:

- The annual fee for UOB Visa Infinite Card is waived for spending of RM50,000 per year and more.

- The annual fee for UOB Lady’s Solitaire MasterCard is waived for spending of RM30,000 per year and more.

- The RM7.50 per month fee for UOB YOLO Card is waived for a minimum of 1 retail transaction done per calendar month.

Who is Eligible to Apply?

To know the eligibility of one to apply for a UOB credit card, you can take a look below. Please note that the minimum income requirements for expants may differ.

- AGE (PRINCIPAL CARD) : At least 21 years old

- AGE (SUPPLEMENTARY CARD) : At least 18 years old

- NATIONALITY : Anyone

- INCOME REQUIREMENT (MONTHLY) : –

- UOB Preferred Platinum Mastercard® (RM3,333)UOB

- Visa Infinite Card (RM10,000)UOB

- Classic Lady’s Mastercard (RM2,000)UOB

- Platinum Lady’s Mastercard (RM4,000)UOB

- Solitaire Lady’s Mastercard (RM8,333)UOB

- ONE Card (RM2,000)UOB

- ONE Platinum Card (RM4,000)UOB

- PRVI Miles (RM5,000)UOB

- YOLO Card (RM3,000)

Application for UOB Credit Card

If you’re interested to apply for a UOB credit card – you can do so by applying online! Before you decide to apply for one, you’ll have to take note of the documents required for the application process. Below are the general documents which you have to prepare beforehand:

DOCUMENTS NEEDED FOR APPLICATION

| SALARIED EMPLOYEE | SELF-EMPLOYED |

| Latest slip of salaryLatest tax return along with LHDN receiptLatest EPF statementsPersonal bank statement (salary credited shown) | Latest tax return along with LHDN receipt Form 9 and 24Latest 6-month bank statements (business turnover shown) |