With so many different types of taxes in Malaysia, new employees who have just entered the workforce can find taxes confusing and burdening. Besides, some existing employees are also having difficulties paying their taxes. Understanding the struggles, our government had proposed PCB to lighten the financial burdens of new and existing employees. In this article, we will be explaining what PCB is and how it works in Malaysia.

What is PCB?

PCB is short for Potongan Cukai Bulanan, which directly translates to Monthly Tax Deductions, otherwise known as MTD. The tax deduction mechanism allows employees to pay their income taxes through monthly installments that are deducted from their salaries. This prevents employees from paying a large sum of income tax at the end of the year.

By implementing PCB, employers are responsible to deduct the monthly installments of income taxes from their employees’ salaries. The monthly installments exclude taxes like zakat payments, child relief, personal relief, and relief of spouse without income.

PCB as the Final Tax

If you’re wondering whether or not to file income tax returns, you can find the answer in this section. According to the Malaysia income tax year of assessment 2014, taxpayers whose PCB acts as their final tax do not have to file income tax returns. Nevertheless, if they wish to reduce the taxable income through reliefs, they can still file income tax returns.

To have PCB constitute your final tax, you will need to meet the following criteria:

- Your current employment is the sole source of income.

- You have worked for the same employer for at least 12 months.

- Your employer has been deducting the accurate amount of PCB from your monthly salary.

- You are paying all of your taxes without incentives from your employer.

- You are not involving in a joint assessment with your partner.

Taxpayers who meet the above criteria may or may not file a tax return. If one has not submitted a tax return before the deadline (30th of April), the individual will be automatically considered as not requiring a tax return. Otherwise, if any of the above conditions are not met, the exemption is inapplicable and a tax return must be submitted.

Income Tax Form TP1

Employers use the Income Tax Form TP1 to indicate their employee’s tax reliefs. After entering the relevant details of their employees, employers will submit this form to the Inland Revenue Board of Malaysia (IRBM), otherwise known as Lembaga Hasil Dalam Negeri Malaysia (LHDN).

Abiding by the Deduction and Remuneration Income Tax Rules 1994, the employers can then remit the amount of money deducted to IRBM on a monthly basis. That being said, employers can help their employees make PCB their final tax by submitting the Income Tax Form TP1.

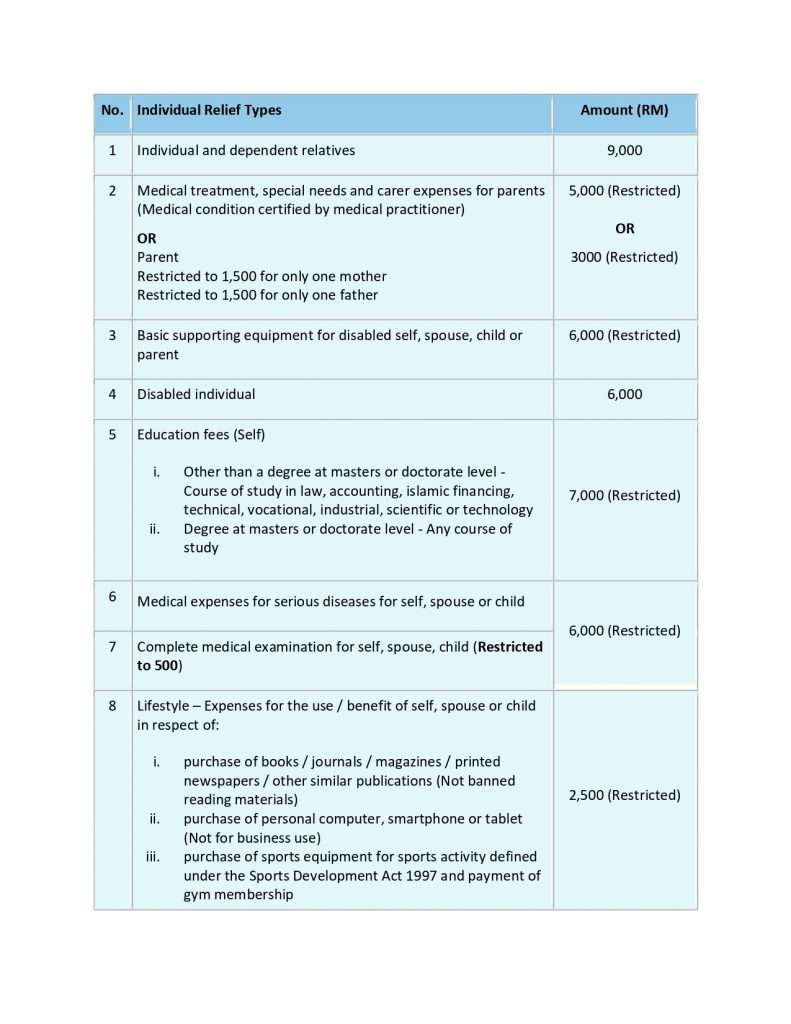

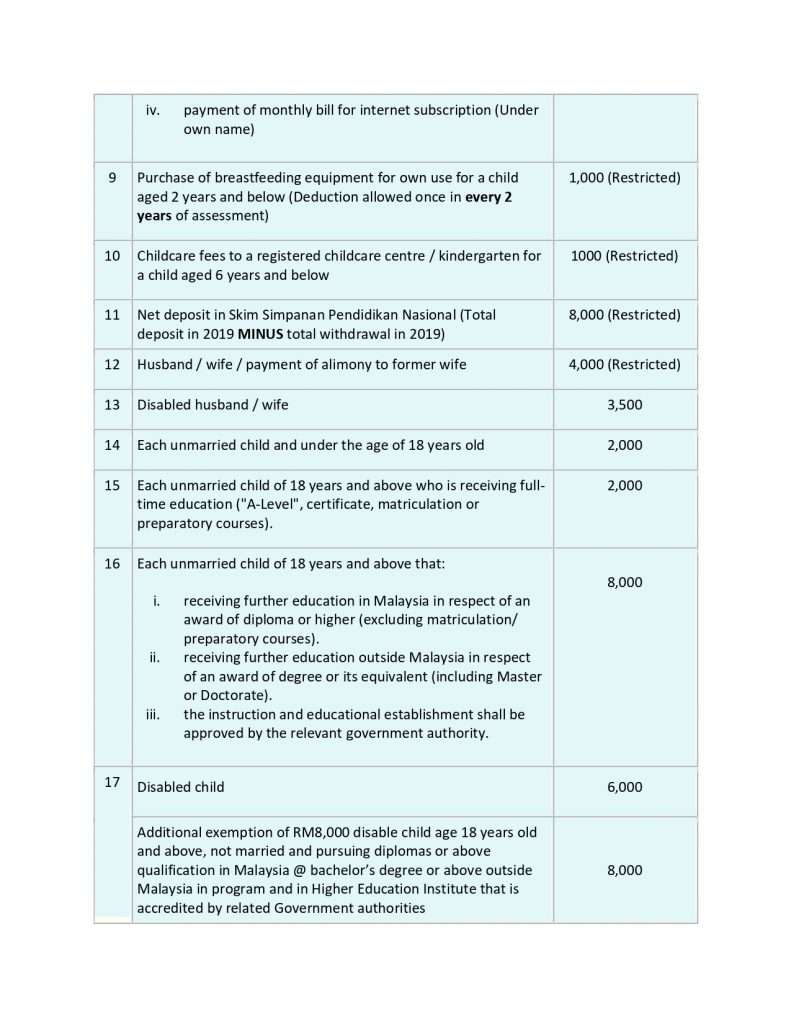

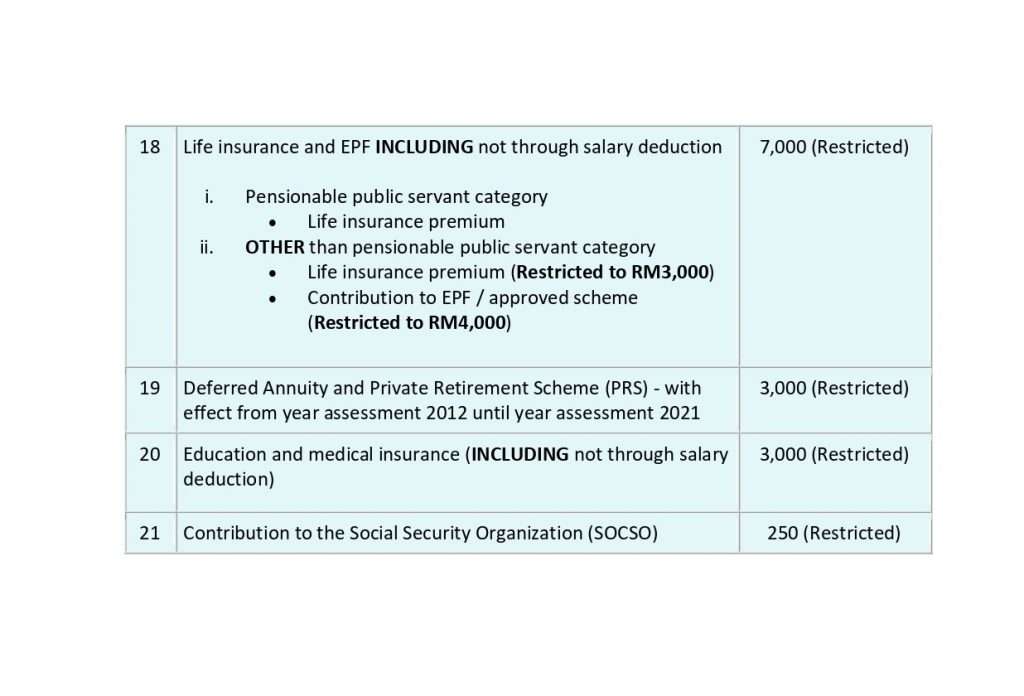

IRBM updates and renews tax annually. The complete and updated list of PCB tax reliefs is accessible through either the official Income Tax Form TP1 or the official website of IBRM. Tabulated below are the tax reliefs in the year of 2019. The official IRBM website can be found here.

Year of Assessment 2019

How to Pay PCB?

There are several ways in which employers can pay PCB. This section outlines 3 of the most common payment methods, followed by the consequences of late payments.

1. Manual Payment

Employers can pay PCB manually by submitting the CP39 or CP39A forms at the payment counter of IRBM. The CP39 or CP39A forms can be submitted in the original, photocopied, or computer-generated formats.

Alternatively, the employer’s cheque or bank draft can be posted to IRBM along with the CP39 or CP39A forms. However, IRMB does not accept cheques that are issued by foreign banks and also postdated cheques. There are 3 collection units for cheques and bank drafts, namely the Kuala Lumpur Payment Centre along Jalan Tunku Halim, Kuching, and Kota Kinabalu.

2. Diskette Payment

Besides manual payment, employers can pay PCB in all branches of Public Bank Berhad and CIMB Bank in Malaysia. To do so, employers need to save their employees’ PCB information in a diskette, following the format outlined by IRBM.

3. Online Payment

This payment method is by far one of the easiest PCB payment methods. You can make payments through online transactions such as internet banking or FPX. It is vital to note that one can only pay for e-PCB and e-Data PCB via FPX.

In the events of late PCB payments, employers will be subject to RM200 to RM20,000 or 6-months imprisonment, or both. If an employer does not deduct or fails to remit the amount to IRBM, he or she can be prosecuted in a civil court. In this case, the unpaid amount will become a debt to the government.

Conclusion

In this article, we have discovered what PCB is and how it works by looking at PCB as a final tax, the Income Tax Form TP1, and how to make PCB payments. However, it is vital to note that this information has only scratched the surface of the topic. To learn more, visit the official IRBM website.

If you’re wondering how to calculate your PCB, use the online calculator here. Alternatively, you can also learn how to calculate manually by referring to a blog post from Talenox: ‘Malaysia Tax Guide: How Do I Calculate PCB/MTD?’.

We hope you find this article useful. If you enjoy reading this article, discover more financing and banking articles via LokaPost and more!